There is still some confusion over how the First-time Homebuyer Tax Credit works.  Hopefully, this explanation will resolve many of the questions you have:

Hopefully, this explanation will resolve many of the questions you have:

Who’s eligible for the tax credit?

First-time homebuyers who purchase a principle residence between April 9, 2008 and December 1, 2009 are eligible. If you (and your spouse, if married) have not owned your principle residence for a 3-year period before your purchase, and you have never taken advantage of the DC first-time homebuyer credit, you qualify as a first-time homebuyer.

Hoe does the tax credit work?

Like all tax credits, it will directly reduce the total amount of taxes you owe. When you file your taxes, for the year you purchased your home (2008 or 2009), you will be able to subtract the amount of the credit from your Federal income tax liability, this will increase the size of your refund or reduce the amount you owe. For example, you file your ‘normal’ tax return and find that you owe $2,000 in taxes. With this credit, your tax liability could be lowered by $8,000 – which means, you instead get a $6,000 tax REFUND check from IRS.

I still don’t understand how much of the tax credit I will get?

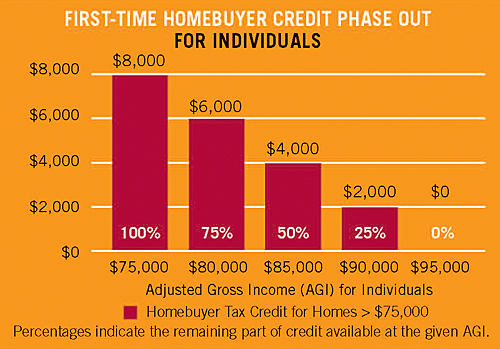

The tax credit is equal to 10% of the purchase price of your home up to $8,000. The full credit is available for single individuals whose adjusted gross income is less than $75,000. If your adjusted gross income is greater than $75,000 and your home purchase qualifies you for the full credit, the credit phases out according to the dollar amount (or percentage if less than $8,000) in the chart below.

For married couples filing jointly, the credit begins to phase out at an adjusted gross income of $150,000. The dollar amounts in the chart below correspond to a phase out of the full tax credit (percentages are for credits less than $8,000).

For married couples filing jointly, the credit begins to phase out at an adjusted gross income of $150,000. The dollar amounts in the chart below correspond to a phase out of the full tax credit (percentages are for credits less than $8,000).

I’ve heard I have to repay the tax credit over time, is that still true?

The American Recovery and Reinvestment Act of 2009 made a big change to this tax credit by removing the repayment provision on homes purchased in 2009. Previously, the tax credit had a payback provision that made it similar to an interest free loan that would have been paid back in full over 15 years (or at the time of resale unless the home was sold at a loss). Now the repayment provision is gone from the updated credit, unless you sell your home within 3 years of purchase – the entire amount of the credit needs to be repaid if that is the case.

Still have more questions (most of us do)? Please contact your Perry & Co. Agent for further explanation.

Click here for our earlier breakdown of the First-time Homebuyer Tax Credit.

- Share this:

- StumbleUpon

- Digg

Filed under: Home Buying, Information For Realtors, Market Conditions | Leave a Comment

Tags: ARRA, First Time Buyers, First-time Homebuyers, Perry & Co, Real Estate, Tax Credit

-

Pages

-

Categories

-

We’re blogging about…

Barb Perry Betsy Lutz Brad Colburn Brooke Granville Carla Bartell Cherry Creek Chuck Anderson Cindy Webb Claire Averill Corrie Lee Courtney Ranson Dagley Arnold Dave Browning Denver Denver Colorado Real Estate Denver Neighborhoods Denver Real Estate Don Larrance Facebook Gina Cornelison Heather Parness Home Buying Home Selling Homes For Sale Jon Larrance Karen Nichols Kim Hutchins LeadingRE Leading Real Estate Companies of the World Letters of Commendation LinkedIn Lorrie Grillo Luxury Homes For Sale Luxury Real Estate LuxuryRealEstate Board of Regents Mary Sullivan-Ridge Pam Parker Perry & Co Perry & Co. Agents Positive Attitude Real Estate Relocation Sue Bickert Tammy Phillips Twitter -

Recent Posts

- Perry & Co. Wishes You A Happy 2010 Thanksgiving

- Letter of Recommendation for Perry & Co. Denver Realtor Courtney Ranson

- Letter of Thanks To Perry & Co. Agents Sue Bickert & Karen Nichols

- The Perry & Co. Realtor Interview: Kristi Lucas

- Perry & Co.’s Heather Parness Makes Denver Business Journal’s Top Ten In Denver Colorado Real Estate!

-

Partner Blogs

- Caribbean Islands Blog Caribbean Islands Realty

- East Bay Real Estate San Francisco Real Estate

- Lawrence Realty Squaw Valley Ski Area (Lake Tahoe) Real Estate

- Leading Real Estate Companies of the World The LeadingRE Real Estate Beat

- LuxuryRealEstate.com Most Viewed Luxury Real Estate Website In The World

- Marquette Turner Australian Luxury Homes

- Marquette Turner Asia/Pacific Luxury Homes

- Reality Sense Spain, Algarve, Tuscany & Switzerland Real Estate

- Rimontgo Luxury Homes in Spain

-

Perry & Co Agent Blogs

- Courtney Ranson

- Kirk Hartshorn

-

Archives

-

Follow Perry & Co. VP Jon Larrance

Error: Twitter did not respond. Please wait a few minutes and refresh this page.

-

Follow Perry & Co on Facebook

FB.init("109f41a9e56dff3b4dbbd4772757f3df");Perry & Co. Real Estate Professionals on Facebook -

Blog Stats

- 40,751 viewings

No Responses Yet to “The First-time Homebuyer $8,000 Tax Credit Explained”